Which of the Following Could Have Equity in a Business

Which of the following transactions could correspondingly occur. Discuss the following statement.

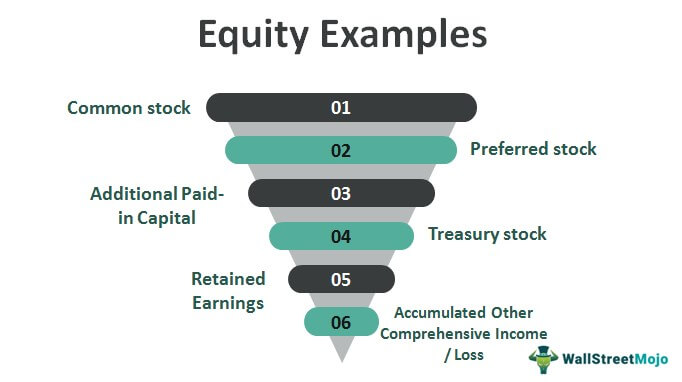

Equity Examples Most Common Examples Of Shareholders Equity

B a silent parter is involve in a parnership and limited to provide capital without participation in management meetining.

. Purchase of a delivery truck for 15000 cash. Total revenues less total expenses. A the owner of a business has the entire equity of a his business.

A transaction caused a 15000 decrease in both total assets and total liabilities. Which ONE of the following transactions made by a business will have an effect on the equity figure in the statement of financial position. Increased equity and increased assets.

Negative shareholders equity could be a warning sign that a company is in financial distress or it could mean that a company has spent its retained earnings and any funds from. Total assets less total liabilities. Personal equity Net worth The concept of equity applies to individual people as much as it does to businesses.

The Bottom Line. W ithdrawal of capital of P10000. Nelson Company experienced the following transactions during Year 1 its first year in operation.

To raise capital for business needs companies primarily have two types of financing as. It might even be the case for those only holding short-term receivables. That is certain to be the case for those with long-term loans equity investments or any non-vanilla financial assets.

This transaction had no immediate effect upon the owners equity in the business. Total assets and liabilities. Write the letter of the correct answer when an entity performs services.

Asked Jul 7 2021 in Communication Mass. Cars and other vehicles. Who are the experts.

Net income Revenue of 4600 Expenses of 3200 1400. All equity accounts with the exception of the treasury stock. Equity can come from payments to a business by its owners or from the residual earnings generated by a business.

Stockholder equity also represents the value of a company that could be distributed to shareholders in the event of bankruptcy. Common examples of personal assets include. Private equity returns outperform the market.

Any entity could have significant changes to its financial reporting as the result of this standard. Fundamentals of accountancy business and management test multiple choice directions. In simple terms owners equity is defined as the amount of money invested by the owner in the business minus any money taken out by the owner of the business.

Of course most people understood fundamental equality. Nonprofit organizations like PBS have to please both the public and the ___ in order to continue to receive funding. Equity accounts are the financial representation of the ownership of a business.

If a real estate project is valued at 500000 and the loan amount due is 400000 the amount of owners equity in this case is 100000. 9 affects more than just financial institutions. For the first time in my 25 years of being a diversity and inclusion expert and consultant companies are beginning to have conversations about equity in the workplace.

Experts are tested by Chegg as specialists in their subject area. This transaction could have been. In accounting the companys total equity value is the sum of owners equitythe value of the assets contributed by the owner s.

If the business closes shop liquidates all its assets and pays off. But it was difficult for leaders and HR managers to wrap their heads around diversity and inclusion in the early daysBy the time I. We all have our own personal net worth and a variety of assets and liabilities we can use to calculate our net worth.

Equity Assets Liabilities. The receipt of a loan to purchase equipment B. It can be represented with the accounting equation.

Discuss and describe some of the reasons for the collapse and whether this collapse could have been prevented. The introduction of the owners motor car into the business D. Generally speaking equity is the value of an asset less the amount of all liabilities on that asset.

Asked Jul 25 2021 in Business by MadDecent. Which of the following defines equity as it relates to a business entity. As it is a member of a parthership it has a part in the partnership equity.

In the late 80s there was a collapse of the junk bond market. The payment of trade payables C. Equity Financing vs.

Companies raise money because they might have a short-term need to pay bills or have a long-term goal and require. This equity becomes an asset as it is something that a homeowner can borrow against if need be. 1 Acquired 12000 cash by issuing common stock.

Furniture and household items. Because of the different sources of equity funds equity is stored in different types of accounts. After taking 45 billion in taxpayer funding to remain afloat CitiBank spent 50 million on a new private jet.

The purchase of inventories on credit. 3 Paid 3200 cash for operating expenses. You can calculate it by deducting all liabilities from the total value of an asset.

C the stockholders has shares of a firm thus a portion of a business equity. Equity financing is the process of raising capital through the sale of shares. 2 Provided 4600 of services on account.

Do You Use Fundamental Analysis To Research A Company If You Do Here Are Six Ratios You Might Have Money Strategy Investment Analysis Money Management Advice

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Which Of The Following Is An Example Of A Cross Functional Business Process In 2022 Business Process Business Intelligence Hiring Employees

0 Response to "Which of the Following Could Have Equity in a Business"

Post a Comment